Ira tax deduction calculator

10 percent for income between 0 and 19050. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

The after-tax cost of contributing to your.

. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If you have a traditional IRA rather than a Roth IRA you can contribute up to 6000 for 2021 and 2022 and you can deduct it from your taxes.

Certain products and services may not be available to all entities or persons. Individuals will have to pay income. If its not you will.

Many factors can affect your eligibility and contribution limits to either the Traditional IRA or Roth IRA tax filing status your current earned income level and whether or not you participate in a. You can add another 1000 to that. We are here to help.

If you would like help or advice choosing investments please call us at 800-842-2252. Money deposited in a traditional IRA is treated differently from money in a Roth. The after-tax cost of contributing to your.

Find out how much you contributed to your IRA this tax year. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Your IRA custodian should send you a statement for tax. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Your IRA will contribute 2781 month in retirement at your current savings rate Your tax savings will be 852127 when you retire Tweak your numbers below Basic Annual Contribution 6000.

AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Traditional IRA Calculator Details To get the most benefit from this.

While long term savings in a. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income.

This means your taxable IRA withdrawal will be taxed at 24 percent. The after-tax cost of contributing to your. For married couples filing jointly the tax brackets are.

Follow these three steps to calculate your IRA deduction. Retirement plan at work. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe.

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Federal Income Tax Templates Archives Msofficegeek

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

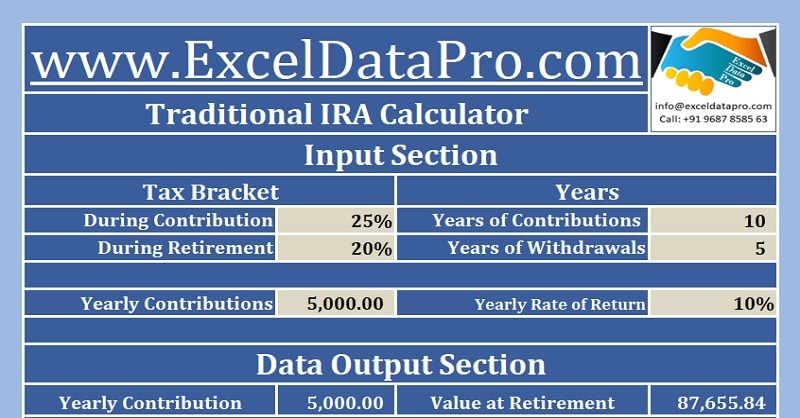

Download Traditional Ira Calculator Excel Template Exceldatapro

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Free Traditional Ira Calculator In Excel

Traditional Ira Calculations Youtube

Roth Ira Calculator Excel Template For Free

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal